SERVICES

Cost Segregation for New Construction

Ground up, expansions, renovations, interior build outs, leasehold improvements

Cost Segregation for Purchased Facilities

Single facility purchases, portfolios of purchased facilities

Construction Tax Planning

Tax advantageous cost template creation, coordination with construction teams, contractors, and accounting professionals

Qualified Improvement Property Identification

Identification of Qualified Improvement Property, eligible for 100% bonus depreciation in 2018, 2019 and 2020 per the CARES Act fix

WHAT IS COST SEGREGATION?

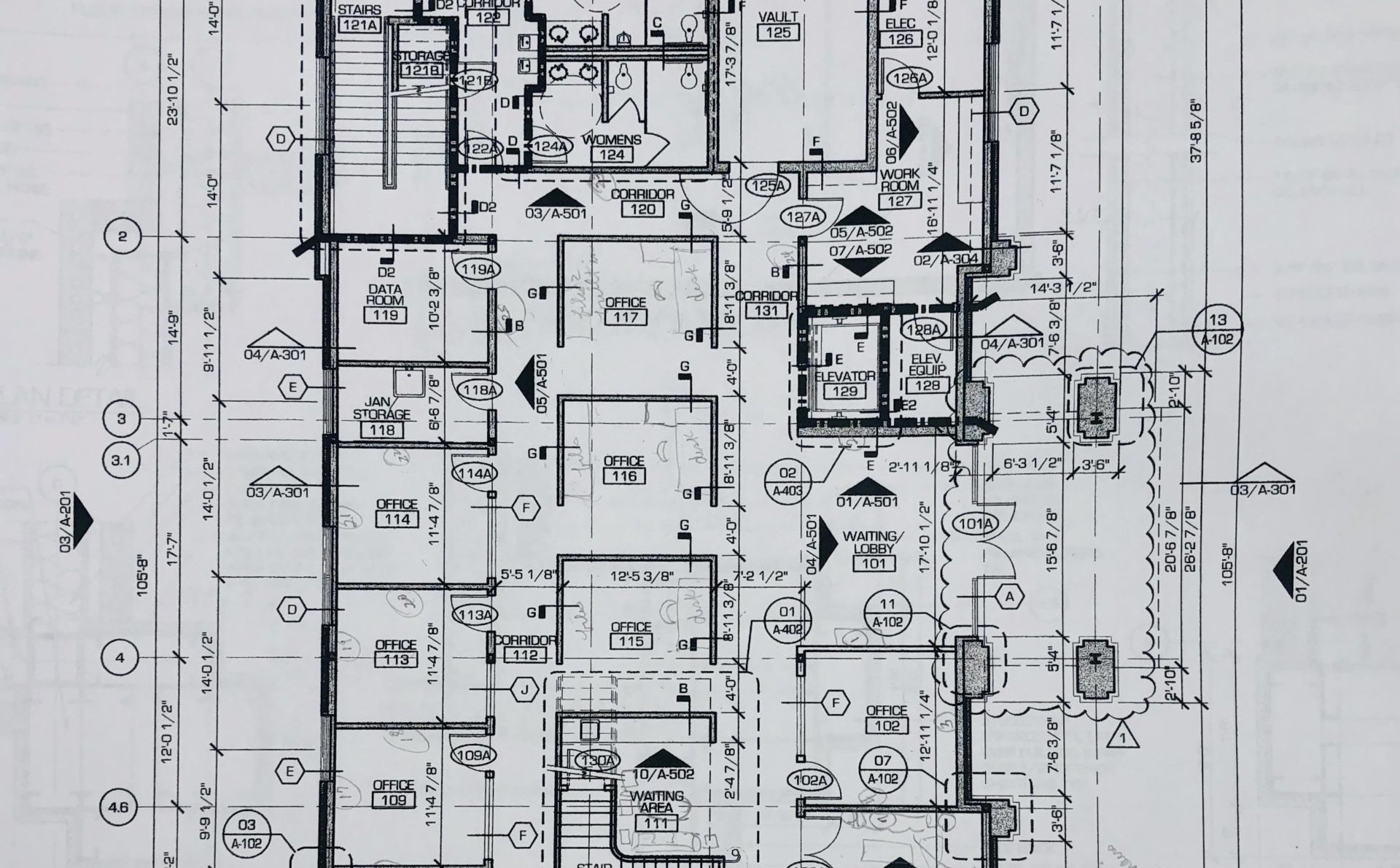

Cost Segregation is the process of classifying real property and personal property for acquired or constructed buildings, expansions, renovations, and leasehold improvements to receive tax benefit. Significant benefit can be achieved by using an engineering approach in carving out costs eligible for a shorter tax recovery period. The engineering approach relies heavily on professional estimating techniques and utilizing construction drawings and available cost information.

Cost segregation can be applied to current year capital investments as well as previous year investments with an automatic accounting method change. Various tax acts over the past 10+ years have led to a complex matrix of available applicable rules to apply to capital investments. Currently, 100% bonus depreciation is available to self-constructed and acquired property with costs acquired and placed in service after September 27, 2017.

Where Does it Apply?

- New construction

- Leased facilities

- Qualified Improvement Property

- Purchased facilities

- Previous year facility construction and purchases

Who Can Benefit?

Taxpayers in virtually any industry:

- Manufacturing

- Real Estate

- Retail

- Residential

- Office

- Hospitality

- Industrial

- Commercial

ABOUT

Michelle seagraves

Owner/Principal

Cost Segregation Boutique LLC is a certified WBENC woman-owned business. It was founded in 2020 by Michelle Seagraves. Michelle has almost 20 years of experience providing clients with substantial tax savings related to the engineering-based cost segregation of their capital assets. She has provided analysis for new construction, renovations, expansions, and purchased facilities in a wide variety of industries, including manufacturing, industrial, retail, restaurants, health care, and real estate. Michelle has performed a large number of analyses involving statistical sampling, and is a leader in early involvement cost segregation analysis, which includes working with the construction teams during the project lifespan to maximize benefit carveout.

Michelle has a strong understanding of tax law, engineering technique, and practical construction experience, which she has leveraged in her cost segregation career.

Prior to opening her practice, Michelle was the Central and Southwest Area Leader in Ernst & Young LLP’s Cost Segregation group in National Tax. She began her cost segregation career at Arthur Andersen and also worked for Crowe. Prior to her cost segregation career, Michelle was employed as an architect.

Michelle attended the University of Illinois and received her Bachelor of Science in Architectural Studies degree, Master in Architecture, and her Master in Business Administration degrees. She is a member of the American Society of Cost Segregation Professionals (ASCSP).

CONTACT

Cost Segregation Boutique LLC

Michelle Seagraves

Michelle@costsegboutique.com

312.285.3570